Rolling the Dice: on Terra & 777s w/ Ed

Rainmaker Niccolo joined Diagonal Finance as Head of Ops & Ed talks Terra, the AVAX Treasury Swap, and, most importantly, Casinos.

Before we start, a little preface about Sunday. We’re testing splitting up the interviews we tend to do in the Chainletter from the summaries of our Discord’s conversations. This is to say, stay tuned. Best.

Community Updates

Rainmaker Niccolo has joined Diagonal Finance as Head of Operations.

Diagonal enables businesses to integrate streaming payments in their existing payment stack, through audited smart contracts, simple APIs and reliable off-chain infrastructure. We simplify the entire process providing a developer experience that is as simple as integrating Stripe.

Our first mission is empowering providers (i.e. newsletters, discord/telegram channels, RPC providers, analytics, research...) to monetise their services through crypto-native frictionless subscriptions.

Rolling the Dice: on Terra & 777s w/ Ed

Adept in all things Terra, Ed has been a wealth of knowledge to Chainforest as we explore the ecosystem. I sat down with him recently to discuss the mechanisms of the Avalanche <> Terraform Labs treasury swap and its effects on the “Peg.” Conversation quickly turned to discussion of the (internally) infamous 777 casino, a community owned, open-door online casino. What do I mean by open-door? You’ll find out.

(Also experts in Casino & Gaming Regulation, reach out to him on Twitter)

D: How do you understand the Avalanche Labs <> Terraform Labs treasury swap?

E: TFL is trying to do is create more release valves for when USD gets off its peg. To recap, in May of 2021, there were cascading liquidations on Anchor, people were dumping Luna, and UST fell off peg as a result. Market supply of UST outstripped demand and no one was confident enough in recovery to want to hold UST and didn’t see enough use cases for it. We’re here to tell the tale because Do (Kwon) essentially swooped in acted as the backstop — buying up all this cheap UST. The second he gave that confidence signal, UST went pretty much back up to $1 and Do made a really healthy profit from the arbitrage. With the Avalanche swap, he wants to make sure that doesn't repeat. Historically with algorithmic stable coins, the larger they get, the less potential there is for a single actor to step in and stop a depeg if it happens. Do can no longer step in and say Oh, I'm just gonna use my personal wealth to buy up the UST, because there's now 16 and a half billion dollars worth of USD in the market.

With Avalanche, Do is trying to create these release valves to act as that backstop in the event of a depeg. He's doing that through a lot of different things — this Avalanche reserve, the Bitcoin reserve. The way that I understand it working is, there's going to be a pool of avalanche coins from the $100 mil OTC deal that will fill a virtual AMM living on the Avalanche chain, essentially like Curve, that let you swap UST for 98 cents of Avalanche; 98 cents because Do is looking to make this only activate in the case where UST goes far off peg — say dropping down to 90 cents. There would then be an 8% opportunity for arbitrage. Thus, by draining this reserve of Avalanche, the supply of UST is shrinking and the price of UST goes back up. I think the Avalanche reserve is now $200 million actually and the Bitcoin reserve is now $2.5 billion.

It's a pretty genius idea. What other people are worried about is that obviously when you swap UST for Avalanche, the arbitragers don't want to hold Avalanche. They are going to dump it and when they dump the AVAX, AVAX tanks. This is why you hear some people saying this is bad for Bitcoin or bad for Avalanche. They think it will cause a death spiral and so it's a really interesting debate. I actually don't know who is correct and believe the truth is probably somewhere in the middle. Some people legitimately want to hold the avalanche, some want to dump it. That’s just how the world works. It certainly will be exciting to see how it plays out once it is live.

D: Where does the Terra ecosystem still need to be built?

E: Terra is still underdeveloped as an ecosystem for how large (in terms of TVL) it is.

We're still missing a true perps protocol.

We don't have options on Terra yet.

The NFT space is super underdeveloped. There's no NFT lending and, while there are a lot of NFT marketplaces, there's no true blue chip NFT yet that rivals BAYC on Ethereum or Degen Apes on Solana.

Tooling for DAOs, tracking portfolio, doing analytics are all lacking. There's no Nansen for Terra. There’s no tax software like Koinly. Apollo did just make a multisig, though.

Builders in the space should definitely take a look at the Terra ecosystem because, while it’s missing things it’s also growing fast.

D: Tell us more about 777s.

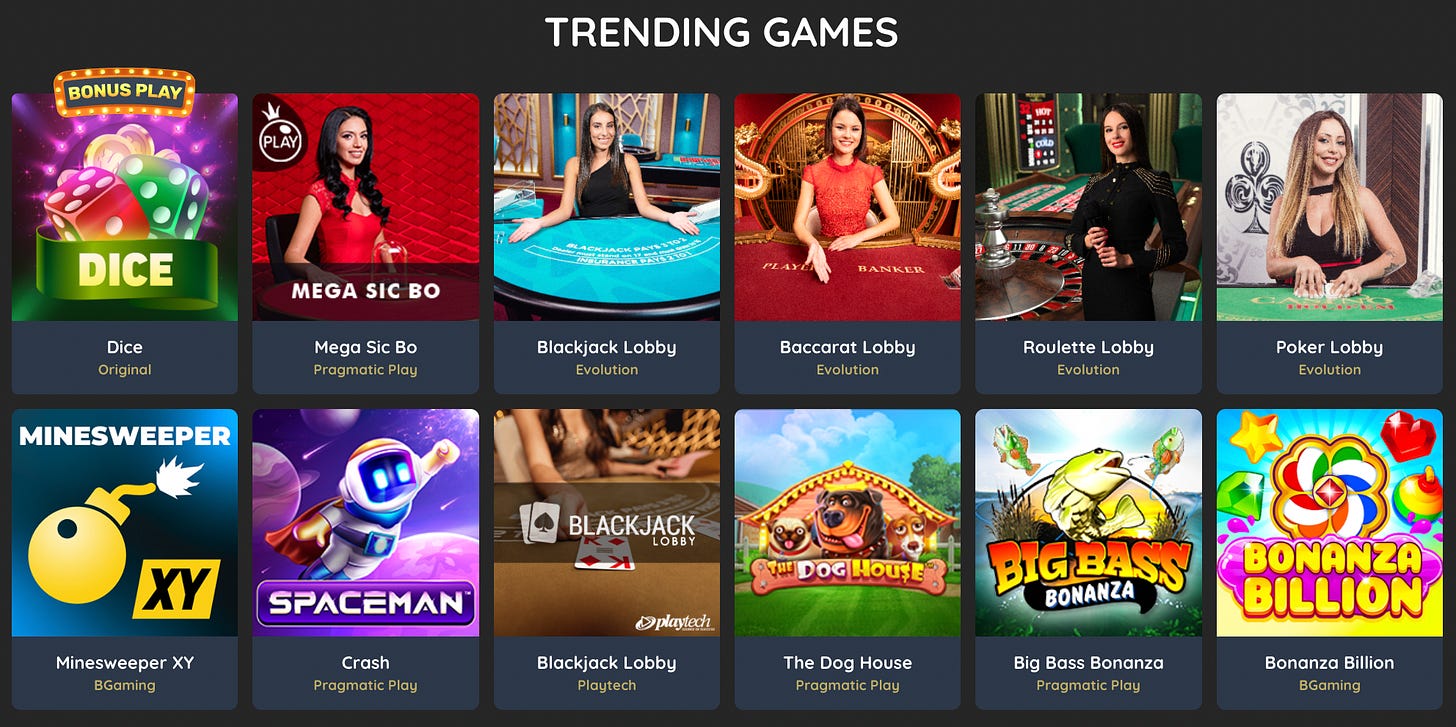

E: I'm in love with this 777s.casino thing. I feel like people don't get it because they haven't tried it. I think it's really interesting. 777s.casino is a community owned casino with live table games, slots, and sports betting. It's community owned meaning 33% of the profits each month —(the casino is about a month old and dividend last month was about $5 and set to double this month)— go to people that hold this NFT that 777 sold to initially bootstrap casino funds. The casino experience is extremely engaging. They use live dealers meaning, if you want to go play blackjack, you sit down at this blackjack table, and you're watching a camera. It's like a zoom call. There's a real human being dealing out cards. They've got these camera systems that recognize which cards got dealt to you and when you hit the dealer knows to show you. It's awesome. When I started doing diligence, I found all the best online casinos with really big brands — FanDuel, DraftKings —use live dealers. I think they actually use the same company for live dealers. The rooms look really professional. The dealers speak English. Also, access is open door. There is no KYC. You click one button, you're in. They take all kinds of currency — LUNA, ETH, USDC, everything. You just deposit it into their escrow account for casino credits. I was looking at this stuff yesterday, on a Monday night, there were 150 blackjack tables live. That’s just not possible in a real casino. They don't fill up 150 blackjack tables, it's just not possible. The VIP tables had people playing $2,000 hands of blackjack. The adoption is insane.

I'm very optimistic that this thing will grow 10, 20, 30x. If that’s the case, the cashflow to these NFT's will be insane. I would love to talk to someone familiar with casino and gaming and regulation to assess the risk. Could this legitimately get shut down? Regardless, in the meantime, I still think there's so much runway, just because they're so young, that they're gonna go under the radar for a really long time. Certainly in foreign countries, they won't even have this problem.

For the last week, I've been thinking about this casino idea a lot. I've been trying to find the other major competitors to this. There’s a few on Ethereum — Gambling Apes, Slotie. Neither of those are exactly the same as 777s. Slotie is just doing slot machine stuff. It's also community owned and you can buy Slotie NFTs on Opensea. Some alpha though, 777s is in talks with Slotie to provide table games for their casino because they've already got the connections. There may be some kind of partnership where, you know, they become one ultra mega casino or something like that. Time will tell.