Chainforest is always searching for passionate, inquisitive individuals to welcome into the fold. Don’t hesitate to apply here.

TLDR

Outside.io is a NFT project that aims to get its users off the computer and into the outdoors.

Can cryptocurrency survive a recession? As the economy starts to take a turn for the worst, cryptocurrency is bracing to take on its first U.S. recession.

The first ever fireside chat within the Chainforest community took place, discussing venture investing.

Crypto In The News

The Federal Reserve released a study in which they surveyed 11,000 people. That survey revealed that 12% of U.S. adults held cryptocurrency in 2021.

GameStop releases their own non-custodial wallet in Beta. The wallet will be based in the Ethereum ecosystem and will allow users to connect directly to the GameStop NFT Marketplace.

High end fashion brand Balenciaga announced they are accepting payment in cryptocurrency. Balenciaga accepts Bitcoin and Ethereum now, with additional cryptocurrencies planned to be accepted in the future.

Terra Luna’s snapshot is expected this coming week, to begin the airdrop of “Terra 2.0”. With a planned supply of over 116 million, holders of Luna pre-crash will receive their tokens periodically over 2 years to prevent an immediate sell off.

Outside.io: The NFT Project Getting People Outdoors

A majority of the Web3 community is focusing on the future of the Metaverse, which will potentially lead to even more screen time. Outside.io takes a different approach and aims to get its NFTs users outdoors. The average American spends 7 hours a day looking at a screen (computers, phone, etc.). As technology increases and our everyday lives become more reliant on computers, that number is likely to continue tp increase. A NFT project “designed to get you outside” sounds counterintuitive, so how is Outside.io accomplishing this task?

A play on the Metaverse, Outside.io has dubbed their community the ‘Outerverse’. The Outerverse consists of three main components; a curated NFT marketplace, a creator platform, and a token with utility and reward characteristics. This may not sound all that different than many other NFT projects, however taking a look at the current projects Outside.io has already running or planned for the future you will begin to get a picture of the value add a project like Outside.io brings into the Web3 community.

Coming this summer, Outside.io will launch its first NFT offered on its platform, the Outerverse Passport, which they advertise as “a living, breathing fun generator”. The NFT will not only be beautifully designed, but also offer its owners special access to future NFT drops, special access to their events and meetups (more on this later), and other community benefits. The Outerverse Passport will be limited in quantity and those interested should follow the community’s Twitter for updates on the launch date and details (note that the planned launch price is $300).

The real world events and meetups is where this project intends to get its users outside and separate itself from other NFT projects. Some NFTs will allow access to once in a lifetime experiences such as cycling with George Hincapie (professional cycler from 1994-2012) or climbing with Sasha DiGiulian (World Rock climbing Champion in the overall category). Other events unlocked by the NFTs are in person meet ups at some of the most popular outdoor events and festivals in the world, such as the GoPro Games or the Warren Miller Film Festival.

The project also plans on launching NFTs with one of a kind art (outdoor themed of course). Incredible one of a kind nature photography and rare and exclusive images from brands like Peloton and Backpacker are just a few of the plans the project has. In addition, the project has partnered with outdoor themed brands such as Yeti and North Face to release free gear, unique access, and discounts on the gear.

The project has charitable ambitions too. 20% of profits from the sale of the passport and future NFT drops will go to a non-profit that aims to “help build the diverse outdoors and wellness communities [they] want in the future”. The project also chose the Solana blockchain because it is more eco-friendly than Ethereum or other layer one blockchains. In addition to running on the low-carbon emitting Solana blockchain, Outside.io plans on neutralizing 100% of their carbon emissions from NFT transactions.

Outside.io is truly a unique project and an incredible use case for blockchain technology. The idea of cryptocurrency combining with the outdoors may seem counterintuitive, but that is what makes the space so incredible.

Cryptocurrency Will Survive A Recession

Most economists will agree that the definition of a recession is two consecutive quarters of declining GDP. Using this definition, The United States has not seen a recession since the “Great Recession” from December 2007 to June of 2009, caused by the collapse of the housing market. However, due to the current situations of inflation, the war in Ukraine, and supply chain issues caused in part by the Coronavirus, there is a major stress on the economy. That stress is likely the last straw on the camel’s back. Larry Harris, the former Chief Economist at the SEC, says that a United States recession is “very likely”, in an interview with CNBC.

Satoshi Nakamoto created Bitcoin in 2008, in response to the “Great Recession”. This means that cryptocurrency has yet to see a recession. Simply put, Satoshi created Bitcoin to lessen our reliance on banks (including central banks), who were largely responsible for the collapse of the housing market due to their reckless lending habits. For those looking for a comprehensive summary of the causes of the housing market collapse the National Council for the Social Studies wrote a great piece. A few reasons for the collapse that one could draw similarities to the current situation is that investors were ignoring fundamentals to chase short-term gains, the Federal Reserve was adjusting their interest rate policies, and there was excessive leverage in the market. All this begs the question, can cryptocurrency survive a recession?

The Bear Case

Cryptocurrency has grown into an over $1 trillion dollar market and many would see that and say it’s here to stay. However, the “too big to fail” argument has been disproved before many times. Lehman Brothers, Bear Stearns, and Citigroup were all considered too big to fail but eventually went bankrupt or were bailed out by the federal government. What’s worse, is that cryptocurrency is unlikely to receive any federal aid in the event of a major collapse, given the fact that it is largely unregulated, and many government officials have publicly voiced their disapproval of the technology. The complete collapse of Terra Luna in less than a week shows the extreme vulnerability of the cryptocurrency market.

Another particularly concerning factor that could lead to the collapse of cryptocurrency is the amount of leverage used in the space. Leverage is the use of debt to buy more of an investment in order to increase potential returns (or losses). Cointelegraph reported that Bitcoin leverage reached an all time high in January of this year. Many exchanges see 10x leverage, 20x leverage, even 100x leverage. This is particularly concerning if we see a major dip in prices, investors will be liquidated out their investments, causing a massive sell off. This will in turn cause more sell offs, leading to a potential ‘death spiral’. Many have drawn similarities to the overuse of leverage in the crypto markets to the poor lending practices that caused the collapse of the housing market.

There are also outside factors the crypto market cannot control that will affect the economy as a whole. The Federal Reserve has recently decided to increase interest rates and says it will continue to do so as necessary to assist the economy and manage inflation. The Federal Reserve is teetering trying to combat high inflation while still trying to maintain a growing economy. Lower interest rates mean more flow of cash in the economy, but is a root cause of the high inflation we are seeing in today’s economy. Higher interest rates means increased borrow costs for businesses and individuals alike, leading to less spendable cash in the economy. In some cases rapid interest rate increases can lead to a recession. A recession is bad for the economy as a whole and as people begin to conserve money for essentials like food and housing, many will not have the extra cash for investing in crypto and may need to sell off their investments to cover these expenses.

The Bull Case

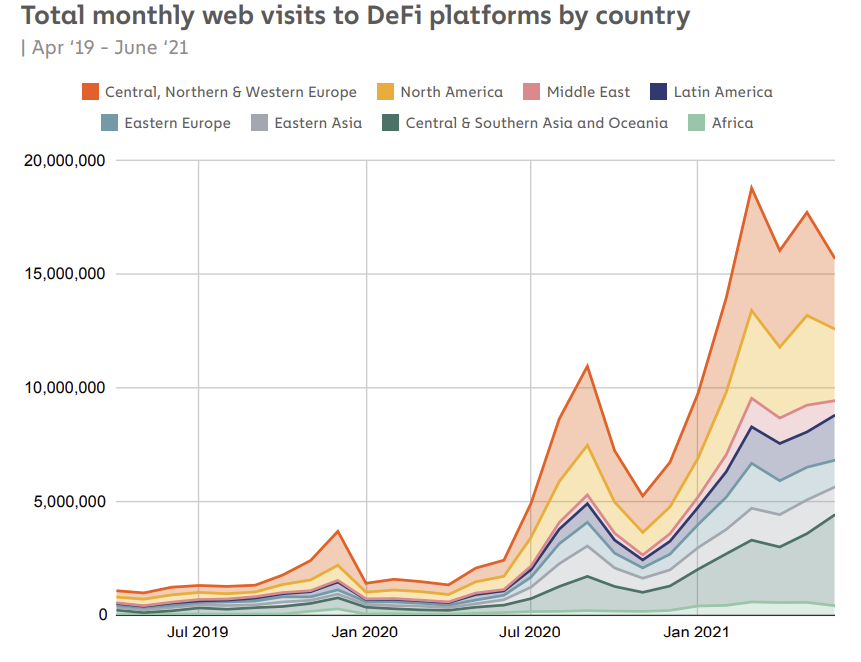

Despite the concerns highlighted in the bear case, there are several reasons why crypto should survive a recession. This article has largely touched on the state of the US economy, and while it is the world’s largest economy, cryptocurrency has become a global asset. Chainalysis released a report titled The 2021 Geography of Cryptocurrency Report, that highlights the true global adoption of cryptocurrency by country, region, platform, etc. Bitcoin has even become the national currency of El Salvador. This kind of global adoption ensures that if one country’s economy collapses, cryptocurrency will have a use case in one of the many other parts of the world that use the technology.

Growth in the blockchain space has not slowed down with the economy. Simply put the cycle of the economy moves faster than the typical start up investment process. A venture capital fund will invest in very early projects, those projects will take time to develop and launch, then the true value of the project will be determined. The first quarter of 2022 saw a record high $10 billion dollars of venture capital investments into the crypto markets, according to The Economic Times. This investment amount means that despite the downturn in the economy, projects are still being built. We will continue to see these new projects being deployed as long as the money is flowing in. Venture Capital funds continue to see value in investing in cryptocurrency despite the increase in regulation and unstable economy.

The biggest factor for cryptocurrency surviving a recession is simply its potential. This sounds like a gross generalization but consider this. Crypto isn’t just a way to pay peers without a bank anymore. There are several active use cases for cryptocurrency, including DeFi, NFTs as art, gaming, and as mentioned in last week’s article Polygon Nightfall is helping fix supply chain issues. There are still many more use cases that have been floated but not fully implemented or reached mainstream usage yet. Using NFTs as housing deeds, digital identity, decentralized storage are just a few examples of massive potential for cryptocurrency. The cryptocurrency market has dipped its toes in many industries, decreasing the chance that the whole market will just collapse.

In conclusion, a recession will cause most markets and industries to suffer. Cryptocurrency will likely suffer more than other industries given its regulatory uncertainty and the fact that the technology is less than 15 years old. But looking at the fundamentals, one can see that the underlying technology and its use cases serve a purpose that will improve the life of businesses and individuals alike. It is difficult to see this all going down the drain due to a downturn in the economy.

Around the Fire: Community Updates

Chainforest member Abraham (@Abraham_L_L) shares his thoughts on DAOs scaling effectively in a twitter thread:

The Chainforest community held a discord member only fireside chat with the community discussing Venture Investing. This is the first of many events on the Chainforest Stage discord channel.