A Close Look at Chainforest’s Venture DAO Structure and $RAINDROP Tokenomics

Chainforest’s most unique design as a venture capital firm is its inclusion of our community of Rainmakers, who are incentivized to support our investing process via the $RAINDROP token.

While our model has received almost unanimous praise from the web3 ecosystem, many are highly curious about the specific mechanics of this structure. Some of the most common questions we receive:

Isn’t the token a security?

Do our community members need to be accredited?

Is the community limited to 99 people?

How does Chainforest avoid adverse selection issues?

If I invest in the fund, do I receive $RAINDROP tokens in return?

These are important questions. We do believe we’ve designed Chainforest in a way that is (1) unique, (2) legal, and (3) designed with better incentives than both traditional VC firms and Investment DAOs. This document aims to answer the vast majority of questions related to our community design and the $RAINDROP token.

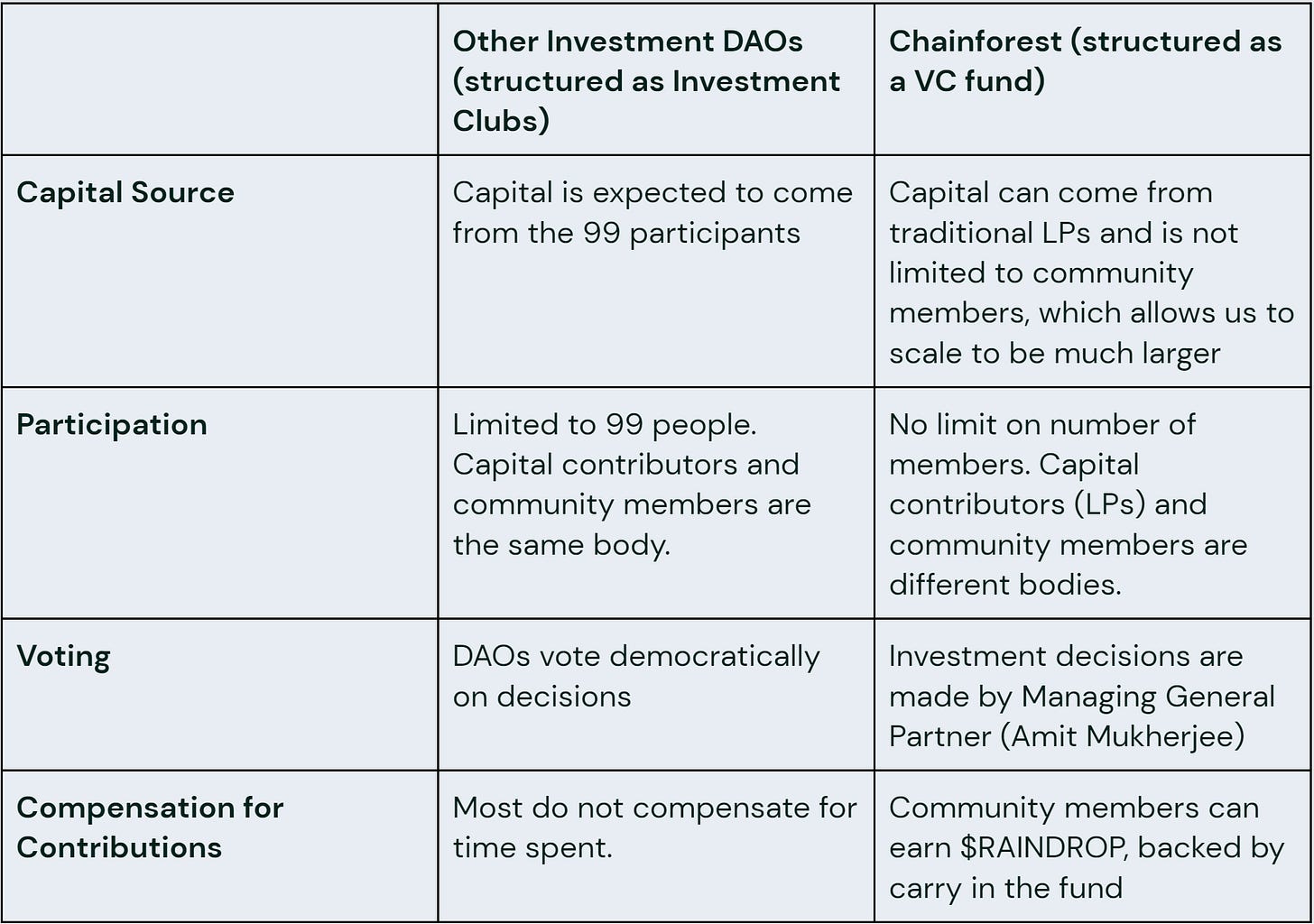

Unlike most Investment DAOs, Chainforest is legally structured as a VC fund and not as an Investment Club

Most Investment DAOs (e.g., Flamingo DAO, Ready Player DAO) have structured themselves as Investment Clubs. In these models, up to 99 participants contribute capital and then vote together on how that capital is deployed. In contrast, Chainforest structured itself as a VC fund. The Investment Club structure is superior for allowing a group of people to all contribute capital together, and collectively vote on its allocation. In contrast, we chose a traditional VC structure for a few reasons.

Firstly, the traditional VC fund structure allowed our LPs and community members to be two distinct groups of people. This allows us to achieve greater skill and to select community members based on their ability to contribute ideas, not capital.

Many of our community members do not have a significant amount of liquidity, but still make amazing contributions to our community and to our investing process. By targeting more traditional LPs for our fund, we are able to scale more effectively.

Secondly, with a traditional VC fund structure, decision-making authority rests with our Managing General Partner, Amit Mukherjee.

This solves two issues we saw with typical investment DAOs. Firstly, the coordination of a vote across as many as 99 members is challenging, particularly when they are part-time. This results in moving less efficiently in a market where speed matters.

Secondly, we have little confidence that wide-scale, democratic voting leads to superior decision-making versus a smaller, more concentrated body. While we believe in crowd-sourcing ideas and expertise from the broader group, our view is that this is very difficult to do when it comes to decision-making. While we don’t believe investing is rocket science, we do think some experience in areas such as diligence and valuation analysis is valuable, and community members are not selected for being experts in these skills.

Thirdly, even if the community was filled with investors who are quite skilled, unless they are highly coordinated on planned portfolio construction and have the perspective of someone who is digging into early-stage investments full-time, it’s unclear that their votes would carry the value of the perspective of a small group of full-time investors.

Initially, we thought that the web3 ecosystem would be highly critical of this more centralized approach to decision-making. However, we’ve found little pushback, and founders strongly favor the more streamlined process.

Thirdly, as a VC fund, we can use carry to back the $RAINDROP token, which is used to incentivize community members to support Chainforest and our investing process.

Most alternative asset managers use the concept of carried interest (or carry for short) to compensate the General Partnership of a fund. Essentially, for successfully executing an investing strategy that generates profit, the investors will receive a percentage of the profits earned. Investors in these funds feel comfortable paying these profits, because these strategies are difficult or impossible to access in public markets, and can result in superior returns.

We use Chainforest’s carried interest to serve as economic backing for our $RAINDROP token. Effectively, all Chainforest community members act as scouts/venture partners/part-time employees of Chainforest, and earn small amounts of carry each time they support our fund.

For the crypto native, this is an exciting prospect. For sourcing a deal or helping with diligence, they can earn a token that has real economic backing! For someone familiar with alternative asset management, the concept may not seem innovative at all. For a traditional financier, we are a traditional VC firm offering carry as compensation just like many other alternative asset managers have done so for employees and consultants. While $RAINDROP fits in a traditional structure, I do believe it presents a unique innovation for web3, and no other VC firm has created a selected community that has the economic opportunity the way we have. Perhaps some of the innovation is primarily aesthetic, but it is working and creating an unfair advantage for Chainforest.

Notably, the $RAINDROP token is not liquid or transferable. This is necessary for the use of this mechanism to be legal and not be deemed a security. We also KYC any Rainmaker who receives $RAINDROP, and issue a K-1 at the end of the year to reflect the compensation they’ve earned via $RAINDROP / Chainforest carry.

This is all summarized in the table below.

FREQUENTLY ASKED QUESTIONS

How do I earn $RAINDROP token?

There are multiple ways to earn $RAINDROP:

Source a deal that Chainforest invests in

Aid in the diligence process for a Chainforest investment

Support a Chainforest portfolio company

Help Chainforest as an organization (e.g., take a part-time role with the community, design an NFT collection for community members, etc)

How much $RAINDROP token will I earn for various activities?

For tasks related to specific investments, $RAINDROP is distributed on a dollar-weighted basis. We’ve created 10M tokens to represent 40% of the carry in the fund. The majority of this (55-70%) is directly allocated for help on investments. We then distribute tokens based on what percentage of the fund a certain investment represents. For example, if our fund was $30M in size and we made a $1M investment, the number of $RAINDROP tokens available would be (55-70%)*($1M / $30M).

For any task related to the investment, 20-50% of the tokens allocated to that deal are made available, at the discretion of the GP.

How does carry work?

“Carry” is the term for the share of profits that investors take from the returns they generate for their investors. Hedge funds, private equity funds, and VC funds all charge carry, typically anywhere from 15-30%.

Investment professionals justify this premium by arguing that they are doing significantly more work to generate a superior return relative to a mutual fund or index fund. A venture capitalist, in particular, has a unique skill set and network in order to access deals that offer 100x+ upside.

This spreadsheet illustrates how carry flows in a VC fund, and if the fund returns 2x invested capital through 7x invested capital, how dollars flow.

How is this legal?

Behind the scenes, we KYC each person who earns $RAINDROP and issue them carry like any VC fund would. The tokens are not liquid or transferrable. If you transfer them to another person, we will still deliver you the carry, and we won’t deliver it to the wallet the token was transferred to. There are no liquidity pools to exchange $RAINDROP for another token.

Won’t community members try to game the system by proposing as many deals as possible?

We haven’t seen this happen, largely because Chainforest is a real community of people who enjoy spending time together and discussing all things web3. If someone was trying to try to earn as much $RAINDROP as possible through deal sharing, we don’t expect the quality of the Chainforest portfolio to decline since our GP (primarily Amit Mukherjee at this point) evaluates every opportunity in order to maintain a high bar.

What is the expected lifecycle of the fund?

10-12 years.

Can non-accredited investors receive the token?

Yes! Tokens are used for compensation, not to represent an investment. Accreditation is only relevant to LPs in the fund, not community members (unless they are also LPs).

Are Rainmakers basically scouts for the VC fund?

While VC scout programs are all a bit different, this is a pretty fair analogy.

What does Chainforest look for in investments?

We’ll write a separate blog post about this and link it here, but Chainforest focuses on investing at the pre-seed and seed level. We invest $100,000 - $750,000 into investments. We are primarily investing in technical founders whose main thesis focuses on the growth of a nascent market or the use of a novel technology. We both lead and follow in deals.